A particularly burdensome process for the state’s judiciary and law enforcement branches is set to change with the September enactment of an insurance verification law passed in 2015. The law will allow law enforcement officials to check whether drivers have valid auto insurance through a new system that links insurance information to vehicle registration numbers.

Legislators hope the system will help curb the high proportion of uninsured motorists in the state.

According to the latest estimates of the Insurance Research Council, an organization dedicated to the research and analysis of public policy matters, Mississippi ranks third in uninsured motorists at a rate of 22.9 percent.

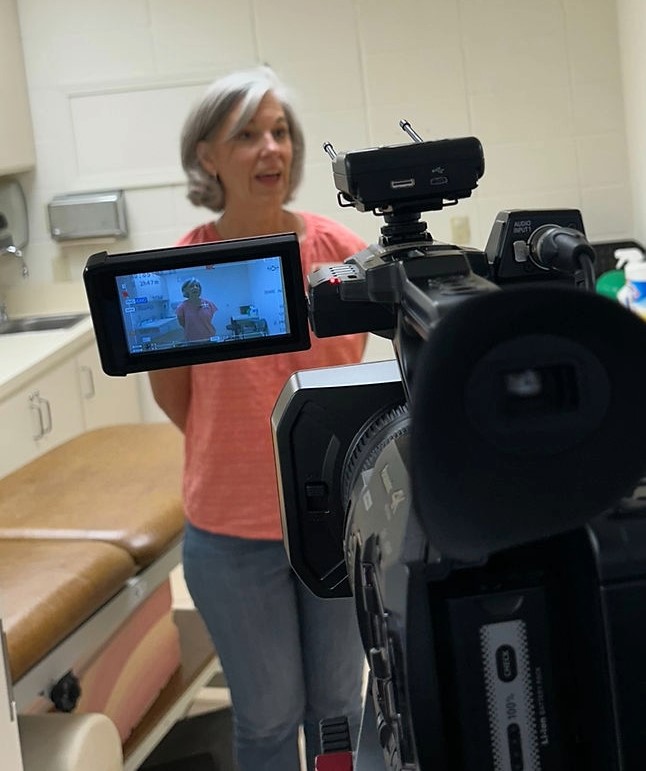

As the state awaits the new system, the Hattiesburg Municipal Court has continued to take on the full weight of the city’s responsibility to ensure those operating motor vehicles abide by state law.

At the beginning of each traffic court session, Hattiesburg Municipal Court Judge Jerry Evans announces that the proof of auto insurance provided to the court will be verified. He warns the room that those who provide false information to the court will be detained and could face the state’s most severe misdemeanor punishment: a $5,000 fine and/or one year in jail.

Evans said one or two people leave the courtroom following his announcement almost every session.

About a year and a half ago, the Hattiesburg Municipal Court was tipped off to a trick employed by a computer savvy segment of the population who falsify insurance information in an attempt to skirt a significant fine levied on the uninsured. As a result, the court began dedicating resources and calling insurers to check the legitimacy of insurance information.

“A student at USM, her mother […] I guess was in a hurry and mistyped [the card] — it said ‘certified diver,’” Evans said. “It was obvious it had been photoshopped, so that caused us to have to start checking them. And we started finding that it was not uncommon for people who were coming to court, especially younger people who knew how to do it.”

Evans said there is an obvious motive to providing falsified insurance to the court. He said people try to take advantage of the state’s insurance statute in order to avoid the $500 fine plus court costs and to avoid getting insurance.

“If they come in and show that they have proof that they had insurance at the time, the statute mandates that we dismiss it,” he said.

Evans said in the past, the court was catching more than 10 people per month for providing fake insurance, though the number has dwindled. He said he makes the announcement to give those tempted a chance to reassess. Still, some take their chances.

“Some people just sit there and think it’ll just slide through and we’re not really going to go call their insurance company, but we in fact do,” he said.

While the municipal court vets each card, Hattiesburg Police Lt. Jon Traxler said the current system restricts police as HPD officers are unable to check every insurance card they receive.

“If we had a way, a national database that that was tracked through, that would be just like a driver’s license,” Traxler said. “Mississippi does not have that. We have to take what they present to us.”

HPD Chief Anthony Parker said Hattiesburg police currently take insurance documents at face value.

“[The officer] looks at the card and if it seems valid he takes it as proof of insurance,” Parker said.

Gary Chism, chair of the Mississippi House Insurance Committee, said that due to time constraints under the current system, Mississippi law enforcement agencies are unable to check the legitimacy of insurance cards provided to them.

“There’s really no way they can do that,” Chism said. “At night, there’s nothing for them to verify it with.”

Mississippi Insurance Commissioner Mike Chaney said the state legislature has tried for at least the last six or seven years to address the issue of uninsured motorists not buying the mandatory liability coverage.

“To address the issue, the legislature has asked the Department of Insurance to consider data dumps by which insurance companies would dump data to the Highway Patrol or some other entity on who had insurance and who did not, which have been done in several other states,” Chaney said.

Chism said Mississippi has outsourced data acquisition to a private vendor. He said House Bill 946, the legislation that allows for the new system, will give police the ability to catch more uninsured drivers before they reach the courts.

The testing period for the system began March 1.

“A police officer would be able to key in your tag number and [the system would show] whether you have valid insurance,” he said. “By Sept. 1, something will be in place.”

Chism said under the new law, being an uninsured driver will remain a secondary offense, which, unlike primary offenses, cannot precipitate a traffic stop.

“Whenever they pull you over for either a ticket, an accident or at a roadblock, they can instantaneously tell whether that card you just gave them is valid or not,” he said.

Evans said after talking presenting his discovery to other municipal court judges at judicial conferences, he found the risk of accepting false information apparently does not concern many of them. He said Hattiesburg Municipal Court, however, has a responsibility to deter insurance falsification, and though everyone occasionally does something stupid, they should avoid testing the Hattiesburg system.

“The caveat is don’t photoshop an insurance card and take it to the court trying to beat the system because it’s not going to happen in Hattiesburg,” Evans said.