The Federal Reserve decided to keep interest rates low as the year has carried on with relative success. While the Fed has the option to do so, this could have deep implications in the rest of our financial system.

NPR reported that the Federal reserve had seen job growth and growing risks and decided to keep interest rates low while allowing for some flexibility.

“So given that balance of good news and growing risks, the Federal Open Market Committee decided to take no action on the target range for

the federal funds rate at the close of its two-day meeting,” NPR reporter Marilyn Geewax wrote.

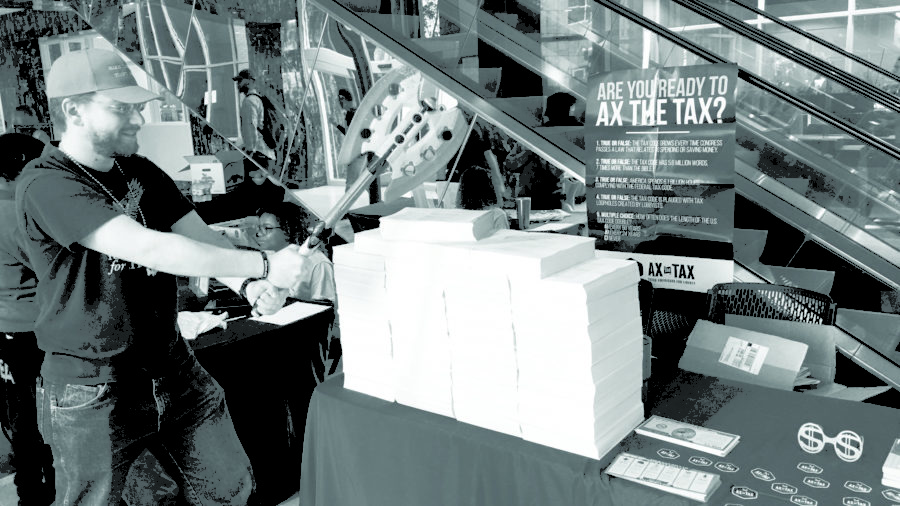

This news comes well for consumers, as they are the ones who benefit from low interest rates. Interest rates, when it comes to the Fed, are typically treated as brakes for inflation. The interest rates function as the government vehicle to curb inflation through federal rate hikes. When the Fed does this, the rates for banks as a whole go up, making borrowing more difficult.

However, people with loan applications flood banks and other lending groups when rates fall. When you buy a house, would you rather be paying 7 percent or 16 percent interest? Of course, the majority will say the 7 percent, because most people like to save money.

Federal rates determine when or if banks are going to raise their rates. Banks can raise or lower their rates if the Fed chooses not to, but it is uncommon. This can make it harder for people to be able to afford the things that they need such as housing and cars. However, the Fed has decided to keep the interest rates down, which will make it easier for people to borrow.

This news comes to the good fortune of many, as this will allow rates to be lower. However, this does nothing to combat the problem of inflation. Unfortunately, inflation keeps going up because there is less control of the currency already in circulation.

The Fed’s Robert Kaplan said he is advocating for gradually increasing the federal interest rates to be able to counteract problems with inflation and urging businesses to continue creating jobs to feed the labor surplus, according to CNBC.

Bankrate.com wrote that the higher interest rates work in America’s favor in multiple ways to be able to raise the dollar exchange rates overseas. The lending rates will increase from where the economy was years ago and will help tame inflation.

While the Fed decided not to go forward with raising interest rates, it still has the option to raise or lower rates in June.