Coronavirus could be equally as lethal to our economy as it has been to people’s lives. Physically, the tangible effects of coronavirus are more and more apparent each day. Out of more than 100,000 cases of confirmed infections, more than 3,000 people have died. However, its effects on the stock market and economic growth around the globe are also becoming apparent.

The pandemic has rocked the stock market. It is not the first time that stock markets have see-sawed after a major news story. Even a piece of small news could raise or tank the stock market by a couple hundred points. In the present condition, however, the stock market is on a roller coaster ride due to panic-stricken investors and their pessimistic sentiments as a portent of the economic decline of the world.

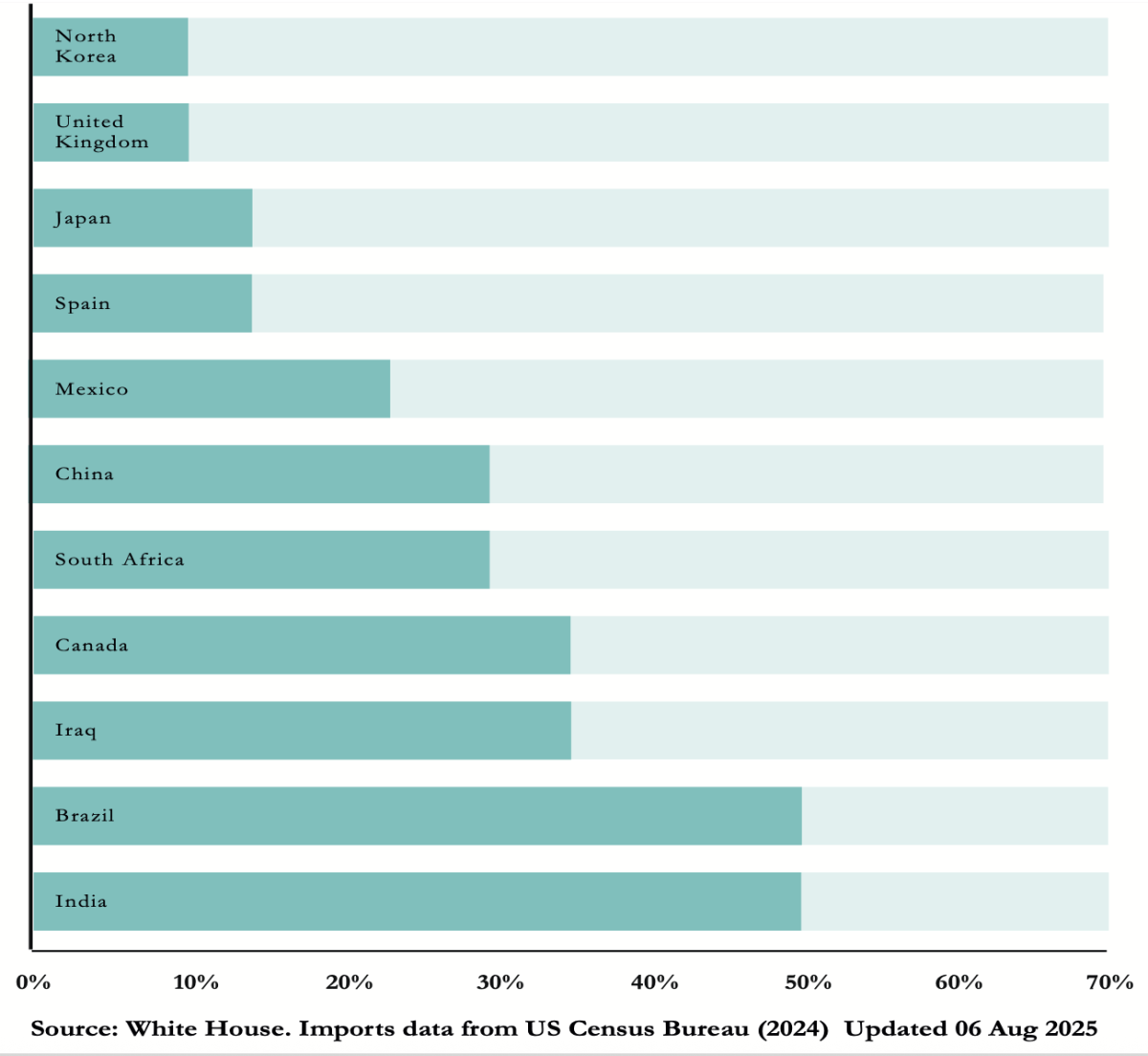

Economic growth has been debilitated ever since the outbreak of the disease both locally and overseas. So far, the Chinese economy has been hit the hardest by the disease. China is the world’s second-largest economy since it is where the majority of the goods we import are manufactured. U.S. companies that are based in China such as Apple Inc. could see their factories shut down. Due to the contraction of manufacturing activities, the exports there have tumbled and the number of tourists visiting the country has declined. For a country that is highly exposed to global trade, the outbreak of this virus could slump its economic growth in an unprecedented way.

Recent death tolls and people infected around the United States have also proven that the U.S. is not impervious to the effects of the outbreak. Schools have been shut down and traveling within the country has scaled back after several airlines have shut their operations.

The stock market is showing the panic of the investors as they brace themselves for even worse news. This is the fastest and steepest decline in the U.S. economy since the financial recession of 2008, and it might be followed by zero percent growth within two successive quarters of the economy.

The Federal Reserve, also known as the central bank of the United States, has taken an unscheduled and emergency action to prevent decline in economic growth. It has cut the interest rates further down to offset the coronavirus impact. According to Jerome Powell, the Chair of the Federal Reserve, these cuts could help reinvigorate the disrupted financial markets as well as tourism and travel industries. Although the foundation of the U.S. economy seems strong, since we have the lowest unemployment rates in half a century, this move by the Federal Reserve could mean that we might have to prepare for the worst-case scenario.

On a global scale, this virus is expected to cut the economic growth rate in half. Harvard Business Review predicts that “the peak decline in global supply chains will occur in mid-March, forcing thousands of companies to throttle down or temporarily shut assembly and manufacturing plants in the U.S. and Europe.”

Coronavirus, being an exogenous factor that hurt the economy, has challenged economists to predict its outcome since they rarely have economic models that could explain such a phenomenon. Time will only tell how bad this decline will be.