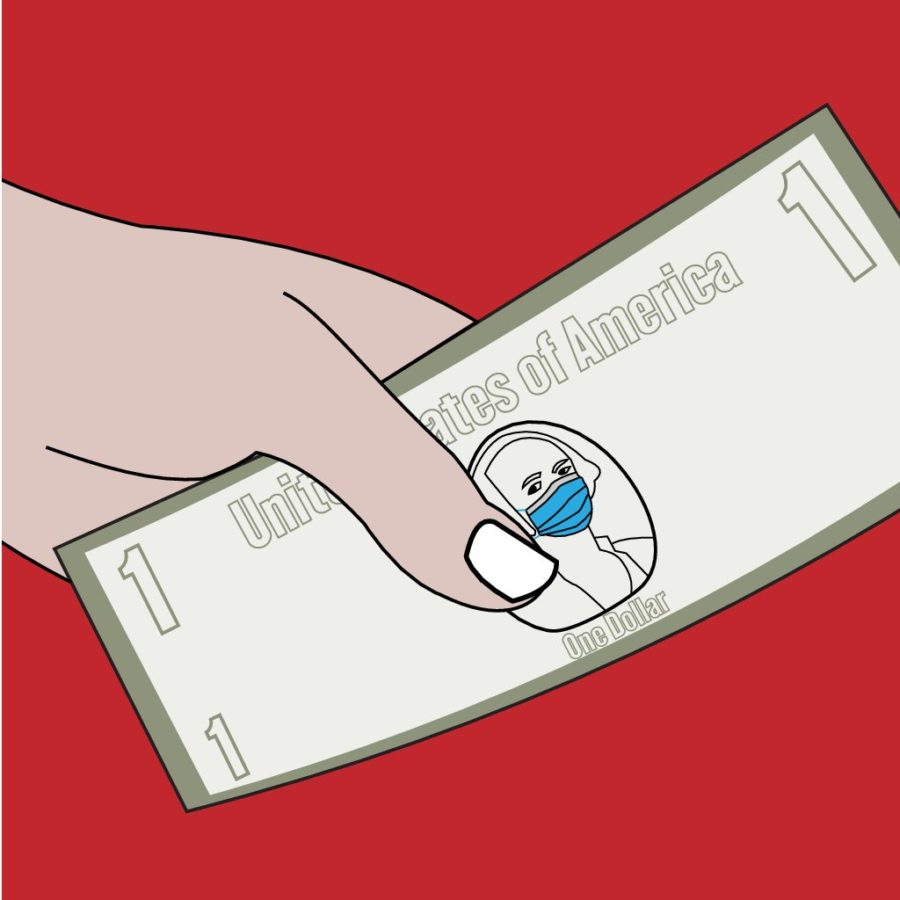

In an economy where a majority of consumers tend to live from paycheck to paycheck, the COVID-19 epidemic has brought difficulties in loans, mortgages, rents, food and utility payments. Since people are advised to stay in their homes and not go to work, many are worried about all the bills due the first week of April.

The 2020 stimulus package, worth trillions of dollars, passed by both houses of Congress and was signed by President Trump. It gives some hope to students who are unable to pay interest on their student loan debt, since they won’t have to pay interest on their current monthly payments. This plan, however, will not cover the outstanding interests that a student has not paid.

There are several other issues that are not covered by this plan. Students who took student loans from private loan providers are not covered and may still have to pay their interests. With the federal government being the biggest holder of student debts, the number of students who will still pay their interests will be small, yet very significant.

Although this plan did not initially cover the monthly payments of student loans, it was announced March 20 that student loan payments will be paused for 60 days. It will not be an involuntary action, though, as students are supposed to communicate with their loan servicers to request for a halt in the payment of their debt.

Alongside the difficulties of paying student loan debt, people are unable to pay for their necessities such as food, water, rents, mortgages and medicines. Plenty of small businesses have closed, which has resulted in unpaid leave and mass layoffs. With about 40% of people not having at least $400 in savings in their bank accounts for emergency expenses, it has become impossible to spend money.

People were especially worried about paying their mortgages and rents due the first week of April, since according to the National Multi-Housing Council, 43 million U.S. households are renters. Local authorities and the government have started working with concerned businesses to prevent people from getting evicted, as well as saving homeowners from the foreclosure of their houses.

After the Housing and Urban Development Department ordered the suspension of all foreclosures and evictions, mayors of different cities all around the country have requested landlords and property management companies to suspend evictions from apartments. Toby Barker, the mayor of Hattiesburg, has worked with the concerned agencies to stop them from evicting the tenants for 35-40 days.

People who are facing unemployment or are infected by coronavirus can get help with their financial burden if they communicate with the people they owe money to. People who are laid off can apply for unemployment benefits that could help them to manage their bill payments for their necessities.

In this pandemic, there are still options for help. Not many options, but they are still there.