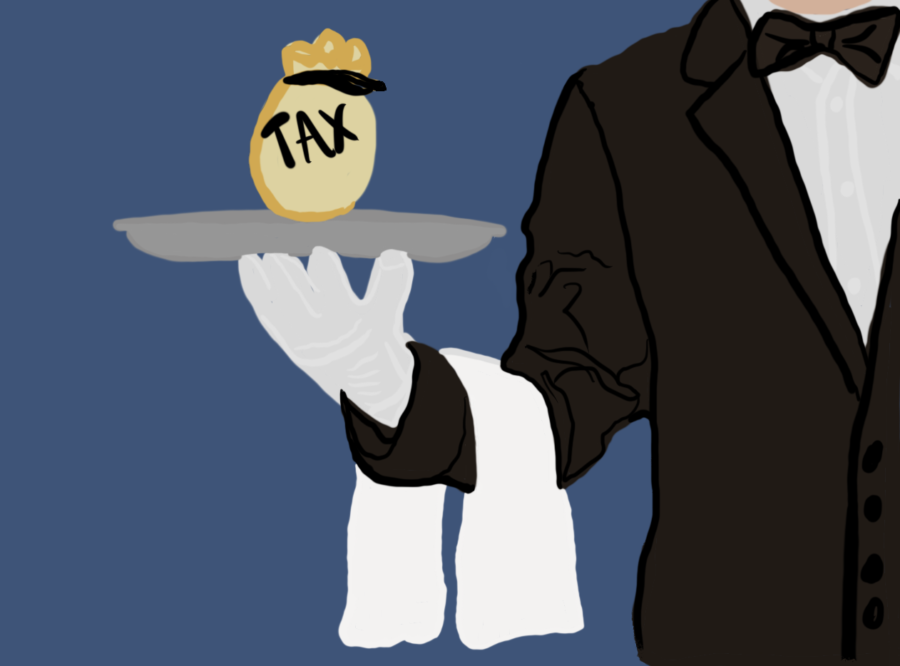

Senator Elizabeth Warren has recently proposed a wealth tax on ‘Ultra Millionaires’, with several of her colleagues in Congress agreeing to endorse it. This proposal could, if enacted into law, level the extraordinary wealth gap between rich and poor Americans, and help reinvest the amount that is collected into useful social causes.

In this plan, Warren outlined what measures will need to be taken so that money from the rich U.S. households will actually enter into the tax system. A new two percent tax will be levied on households that have trusts and net worths between 50 million and a billion dollars. Also, a new four percent annual Billionaire Surtax will be levied on households whose net worth crosses a billion dollars. The revenue through these taxes over a decade is speculated to total over 3.75 trillion dollars. Attempting to evade this tax by renouncing the citizenship of the U.S. will not be easy or cheap, either, since the “exit tax” will make it so someone would have to pay 40% of their entire net worth to leave.

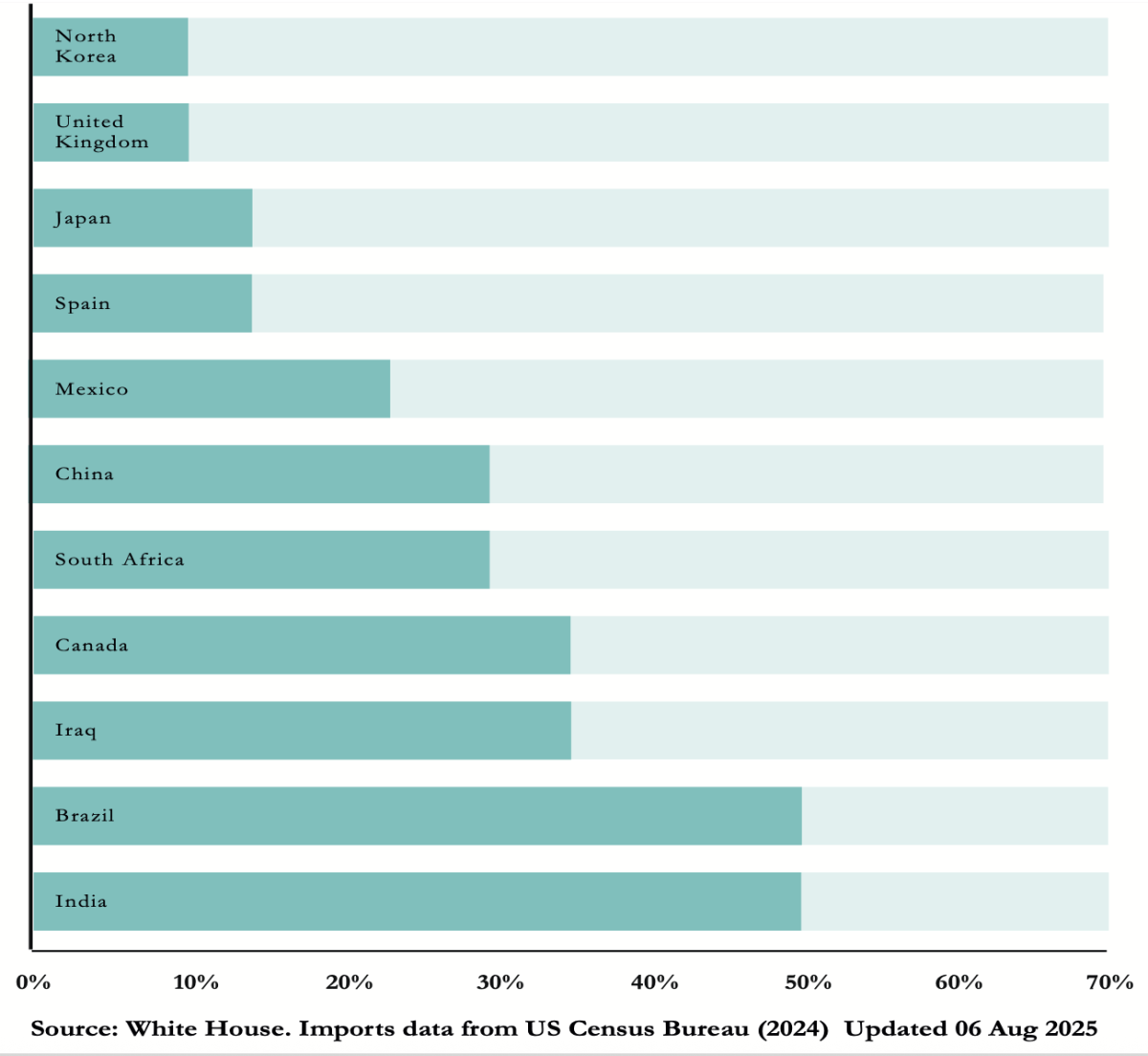

The COVID-19 pandemic exposed a rigged economic system in the United States. While millions lost their homes and jobs as they entered into extreme poverty, wealthy people added billions to their fortune. Over the last 30 years, the wealth share of the bottom 90 percent of households has also been dwindling, but the top 0.1% of families’ share of wealth has skyrocketed.

Some right-wing politicians and experts claim that Warren’s plan is unnecessary, as they are firm believers of “trickle-down economics”, which states money from the wealthy will eventually get reinvested into the economy as it would help them remain wealthy.. To stimulate the “trickle-down” effect, legislators will occasionally raise income taxes on rich households. This process carries a lot of loopholes, however, and its execution is not steady, as tax rates change with new administrations. Thus, Warren’s plan of wrestling stagnated dollars from the ultra-rich and redistributing them to the poor could be a better alternative to the outdated and lousy system of trickle-down economics.

The Warren tax proposal will certainly help those who struggle to make ends meet, but will be even more useful for safeguarding American democracy in the future. Because of rising inequality, regular citizens are unable to utilize upward mobility in the socioeconomic ladder, educational opportunities and entrepreneurship opportunities to improve their lives. These opportunities that define, for many, freedom in American society will flourish if Warren’s proposal is implemented.

The one percent’s chokehold on the nation’s wealth has hindered the economic growth of America. Warren, with the majority of government on her side, could create a novel procedure of redistributing wealth in the United States. The longevity of this plan is uncertain, however, as there are few countries that continue to tax the wealthy in these ways.

If this proposal does get made into law, it will stand the test of time. The U.S.’s economy, ruined by pandemic, will spark to life once again, and the wealth gap between the rich and poor will shrink, bringing better opportunities and living standards for the bottom 99% of people.