Saving Money as a College Student

The minimum wage increase that took place on January 1, 2015 will put more money in the pockets of minimum wage workers, including college-aged workers.-Michael Kavitz

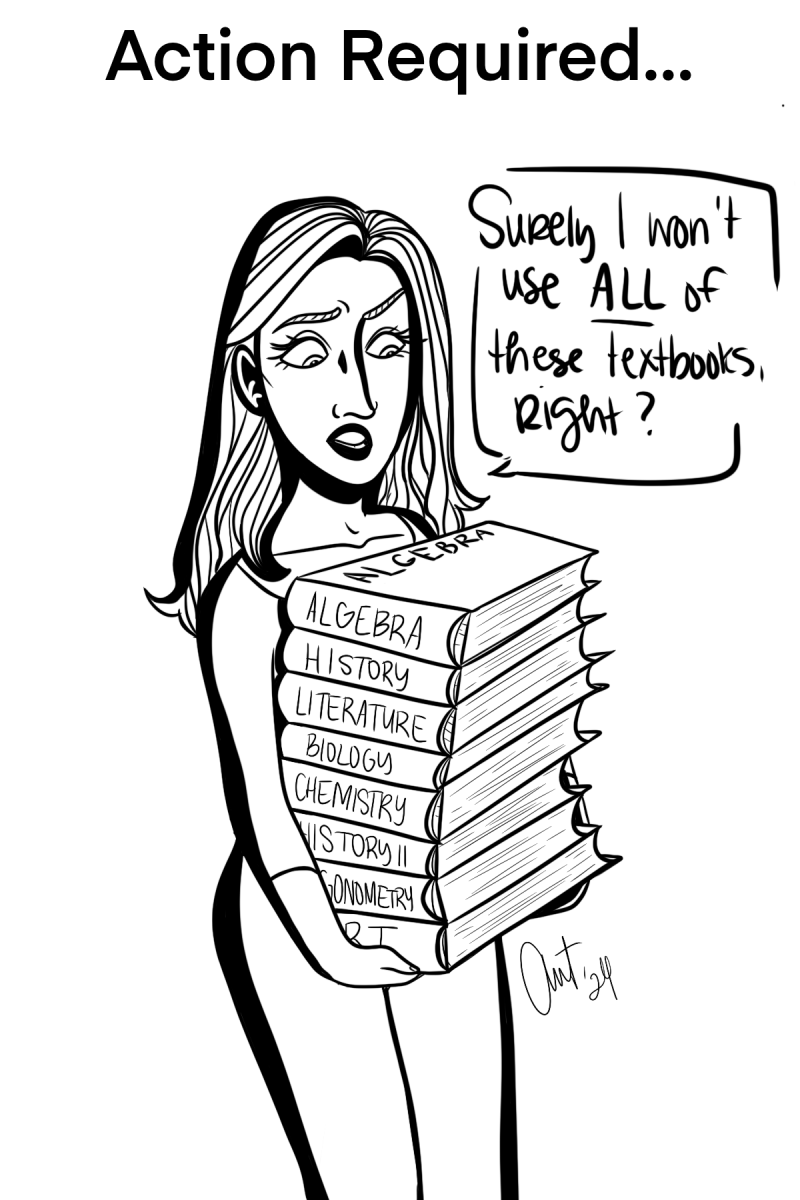

Sometimes, it can be difficult to save and manage money while being a college student.

The decisions of exactly what to spend your money on after getting paid while also trying to save can be challenging.

“I pay my tuition and my bills and budget the rest of my money to last me until I get paid again,” says Teddrionna Lewis, a junior at the University of Southern Mississippi.

Lewis is a criminal justice major here at the University and is a manager at Pizza Hut McComb. When she gets her paycheck, she sets aside a certain amount of money after paying for the most important things.

There are several ways that students can manage their money while balancing the life of being a college student.

Not spending your money on things that you truly do not need is the most important thing to do. This allows you to have plenty of money to spend on your needs, and not just your wants.

USM senior student Jallyah Bolden, majoring in public relations and advertising, dealt with spending her money on unimportant things until she realized the power in budgeting.

“I was getting ready to come to school in August, I went to TJ Maxx, and I spent money that I didn’t even need to spend on clothes that I’m not even currently wearing,” says Bolden.

In most cases, students find themselves purchasing unnecessary things when going shopping, especially with their friends.

Additional clothes and shoes are, most of the time, not even worn or taken out of the bag.

Another way to easily manage your money as a college student is to construct and stay consistent with a budget system.

For example, you can write or type out your monthly earnings, your bills, gas, food and other needs such as school supplies for each month.

After writing out your earnings and what you would be spending the money on each month, then you can easily abide by that system.

You would still have money left over to purchase things that you want after taking care of your needs first.

Learning to do this at a young age now while still in college will help you in the future to be able to budget when you start your career.

“Money is not always easy to come by and you do need to have money put up for a rainy day,” says Bolden. “Building budget skills while you are young is very important.”

“Get you a budget system that works better for your lifestyle,” Lewis suggested to students.

While it is important to budget and spend your money wisely, it is just as important to find a method that works best for you.

Your donation will support the student journalists of University of Southern Mississipi. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.