On Feb. 2, President Obama unveiled his budget for 2016. The new budget proposal boasts tax cuts for the middle class along with plans to increase taxes for businesses and the wealthy, cutting the national deficit by $1.8 trillion over 10 years.

While the president’s Robin Hood-esque budget could possibly give significant relief to middle-class Americans, it will most likely be mangled by partisan legislative disputes.

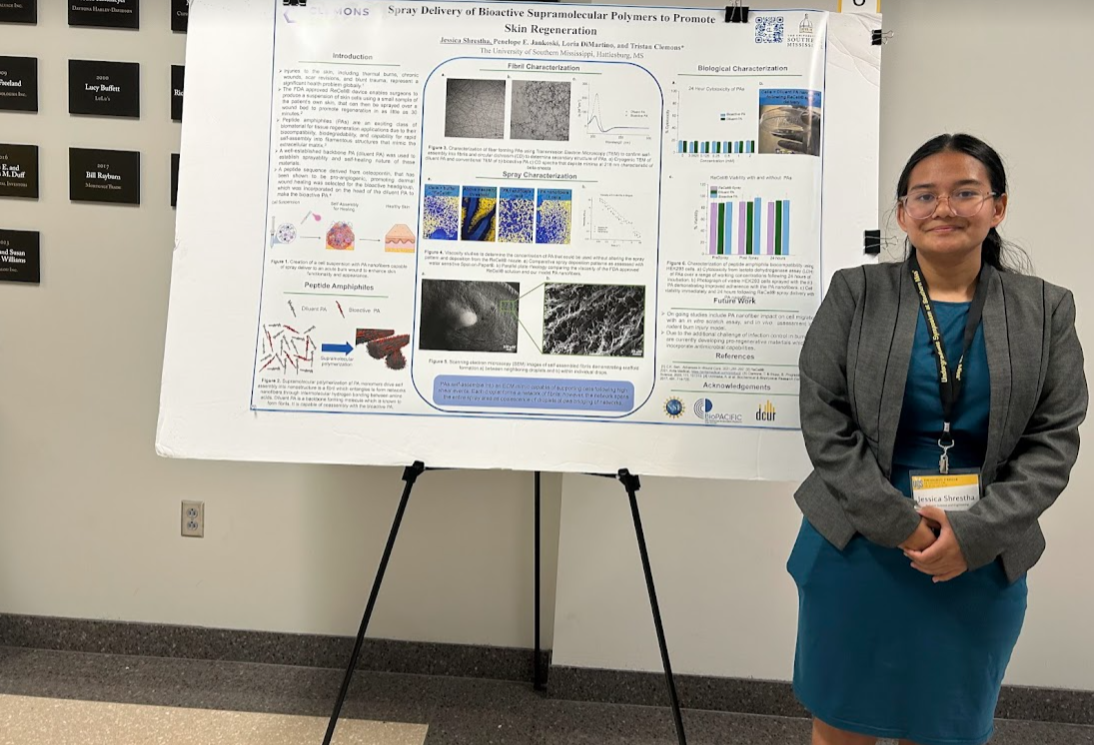

The president looks to fund a couple of his signature education proposals with the new budget. $60 billion would be allocated over 10 years to fund Obama’s free community college program and $66 billion to fund the president’s preschool-for-all initiative.

Another $4 billion would fund teacher training and recruitment. The budget also calls for a 5percent increase in education funding from 2015.

Along with education, the president’s budget takes aim at funding climate change initiatives. $7.4 billion would be used to fund clean energy technologies and $1.29 billion would go to the Global Climate Change Initiative.

The budget also looks to provide $4 billion over the course of 10 years for a Clean Power State Fund, which would encourage states to cut down on carbon emissions beyond their current plans.

In regards to military and defense spending, the budget looks to cut military spending by reducing the size of the military, closing multiple military bases and reducing pay increases for members of the military.

The budget also calls for a Department of Defense base budget of $534 billion, the highest defense budget in history.

Much of the budget seeks its funding from a revamped tax code which focuses on closing the “trust fund loophole,” increasing capital gains tax and imposing new taxes and fees on large financial institutions for big borrowing, while simultaneously expanding tax credits for the middle class.

The new tax credits would include a credit to married couples who are dual earners, given they have a combined income under $120,000.

The revamped tax code would also increase the tax credit for dependent children to $3,000 per child.

Both are ideas that would appeal to many American families looking for tax relief.

As appealing as the newly proposed budget might look to the average American, the president’s proposal is in vain.

The increased taxes on the wealthy along with the budget large amount of government spending makes the budget proposal nothing but wishful thinking from the Obama administration.

Very little of the budget plans will ever even make it to the floor for a vote in either house of the Republican dominated legislature.

The president dropped the ball on this one. He created a budget that would be passed in an ideal world. But, that is just not reality of our government.

Instead of using this as an opportunity to facilitate compromise between parties, the president is attempting to make Republicans look like the bad guys when they shut down tax credits for the middle class and increased funding for education.

Compromise is the key to running a democracy and the president passed up a quality opportunity to meet the congressional majority halfway and instead opted for foolish partisan antics.